Some investors might even have troubles with I bonds’ not enough liquidity. In lieu of producing regular interest payments, I bonds only spend out when they're offered—Which’s only probable a minimum of 12 months just after purchase. Normally, the bonds pay out once they attain maturity 30 years immediately after issuance.

Very long-term bonds can be Definitely wrecked if inflation picks up and buyers be expecting it to stay all around For many years. The key reason why is straightforward: If inflation rises earlier mentioned the bond’s interest rate, you’re getting rid of paying for electric power as time passes.

Mutual fund shareholders, However, redeem shares directly from the fund. The fund supervisor should normally sell fund securities to honor redemptions, probably triggering funds gains which then trickle down to all traders inside the fund.

Making use of this checklist, you'll be able to choose which are the very best in good shape for your certain ambitions and risk tolerance and assist guard your portfolio from the consequences of increasing client costs.

Gold and Precious Metals. Traders concerned about the lowering worth of a dollar may be interested in buying gold or precious metals. The cost of gold and various precious metals is often independent of other asset lessons.

It could get a lot better in the event you’re applying specified varieties of credit card debt to speculate in assets which have been most likely to understand after some time, for example real estate.

No offer or sale of any Securities will arise with no shipping and delivery of confidential supplying resources and related documents. This info contained herein is certified by and subject to far more in-depth information and facts during the relevant featuring materials. Yieldstreet™ isn't registered for a broker-supplier. Yieldstreet™ would not make any representation or guarantee to any future investor concerning the legality of an investment in almost any Yieldstreet Securities.

And as an organization’s revenue grow after some time, Investment grade its inventory rate really should climb. While the stock market could get strike by worries of inflation, the ideal corporations electric power by way of it with their much better economics.

8 This Instrument is for informational purposes only. You shouldn't construe any facts furnished listed here as investment tips or even a advice, endorsement or solicitation to buy any securities presented on Yieldstreet. Yieldstreet will not be a fiduciary by advantage of anyone's usage of or entry to this Resource.

A person type of floating-fee bond that’s backed by the government is known as the Sequence I bond, so you will get inflation defense in addition to the safety of U.S. authorities credit card debt.

Business Insider 20 hrs in the past Buyers Do not Consider the safest bonds of all are a positive factor any more

Investing disclosure: The investment data offered Within this table is for informational and common instructional needs only and should not be construed as investment or fiscal advice. Bankrate would not present advisory or brokerage companies, nor does it provide individualized suggestions or individualized investment advice. Investment choices must be dependant on an analysis of your own personal personal fiscal scenario, desires, risk tolerance and investment objectives. Investing includes risk such as the possible loss of principal.

Buyers can put into practice the following actions to protect by themselves in the declining obtaining electricity of cash for the duration of intervals of inflation:

One of many longest maturities is thirty-year Treasury bonds, and it might go greatly in response to alterations in rates. When you have it and interest rates increase, you’ll be strike with an instantaneous loss in your principal.

Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now! Brooke Shields Then & Now!

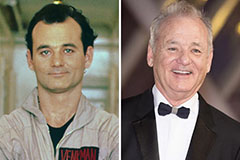

Brooke Shields Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Lacey Chabert Then & Now!

Lacey Chabert Then & Now!